“Final Instructions”

Your “instruction manual” for your children or survivors should begin with the basics. First, do you have a Trust and Will? If so, have you written instructions for your kids (survivors) to follow at your death or disability?

In regards to your estate, are you concerned about probate and...

ILL WILL calls for a Will with Special Terms

Not surprisingly situations occur that drive a person to disinherit a child or heir. My colleague in Wealth Counsel, Greg Turza , offered the following comments, and I am sharing them with you.

Has one of your children run off and joined a religious cult where he was taught to reject...

“My Mother Took Care of Me, So I’m Going to Take Care of Her.”

I’m often asked the question, “What are the options for a baby boomer with aging parents?” I was pleased to see this posting by my fellow Wealth Counsel member Suzann Beckett practicing in West Hartford, CT. She offers one answer for the many baby boomers facing aging parents wishing to remain in...

Filing for Bankruptcy: What Can You Protect?

With 1.6 million Americans expected to file for Bankruptcy this year, we know that at least these 1.6 million and very likely many more researching the bankruptcy option have been asking the same basic questions. “What can I protect?” “What will be left?”

A recent article in the Wall...

Estate Planning Traps

This is a helpful bit of information that a fellow estate planning colleague posted from his law offices in Montana. He’s relatively new to blogging, but I think he’s done well with this information in a summary format. I am reposting his information to share with you.

I seem...

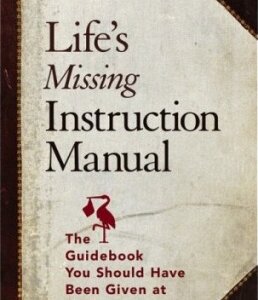

Benjamin Franklin Does Estate Planning

Benjamin Franklin is largely known today for his key roles in the American Revolution, the formation of the United States, and his diplomacy with France. But Franklin was also a very successful businessman. Starting with absolutely nothing, he built a substantial fortune. And he capped it off by demonstrating keen skills developing...

Do It Yourself Planning

Forbes Magazine’s September 7 issue had a thought provoking article on “Do It Yourself Wills”. My Wealth Counsel colleague in Montana, Mark Josephson, took the conversation one step further with the commentary he shared. I hope you find this informative.

Josephson states: “The Case Against Do-It-Yourself Wills got me...